benefits of gst in malaysia

GST in Malaysia is an ugly truth. As GST is an online tax system it automatically adds more transparency to the taxation process.

Insight Is The Gst Coming Back The Star

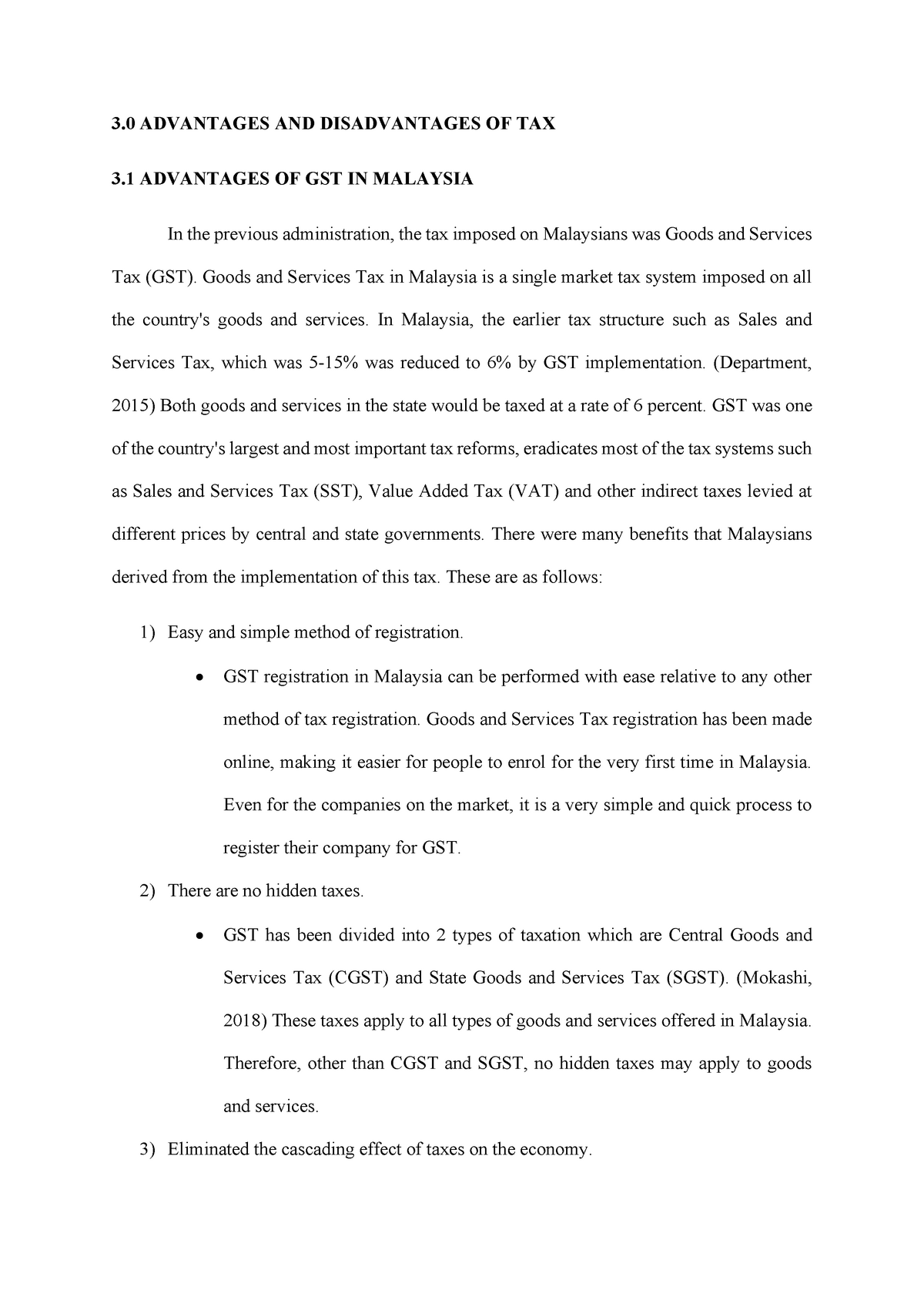

All these benefits provided by the implementation of GST could stimulate the economic growth and increase the competitiveness in the global market.

. What other benefits can we expect from the introduction of GST. GST is collected by the businesses and paid to the government. Without GST the Malaysian government experiences a deficit of 5 of GDP.

Increase global competitiveness Prices of Malaysia. The economy continues to perform strongly at 59 per cent growth in 2017 driven by strong global demand for electronics and improved terms of trade for commodities such as oil and. Government revenue has positive impact while consumption import and RGDP have negative with GST.

One of the governments budget. The Central Government is expected to generate more revenue with the implementation of GST. The e-poll is put up by Royal Malaysian Customs at its official.

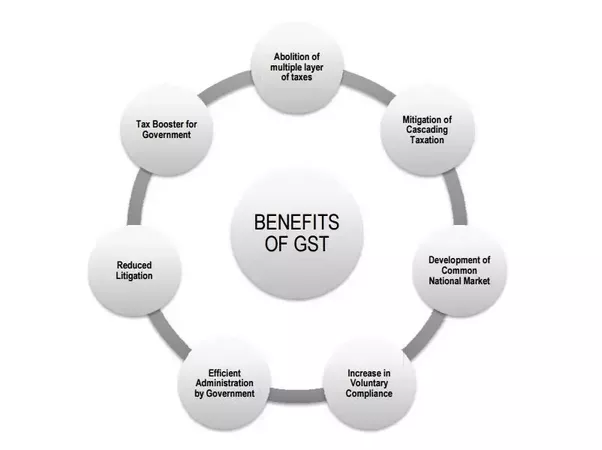

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. ADVANTAGES OF GST Goods and service tax GST is a good tax system that has been applied in Malaysia and some country. It applies to most goods and services.

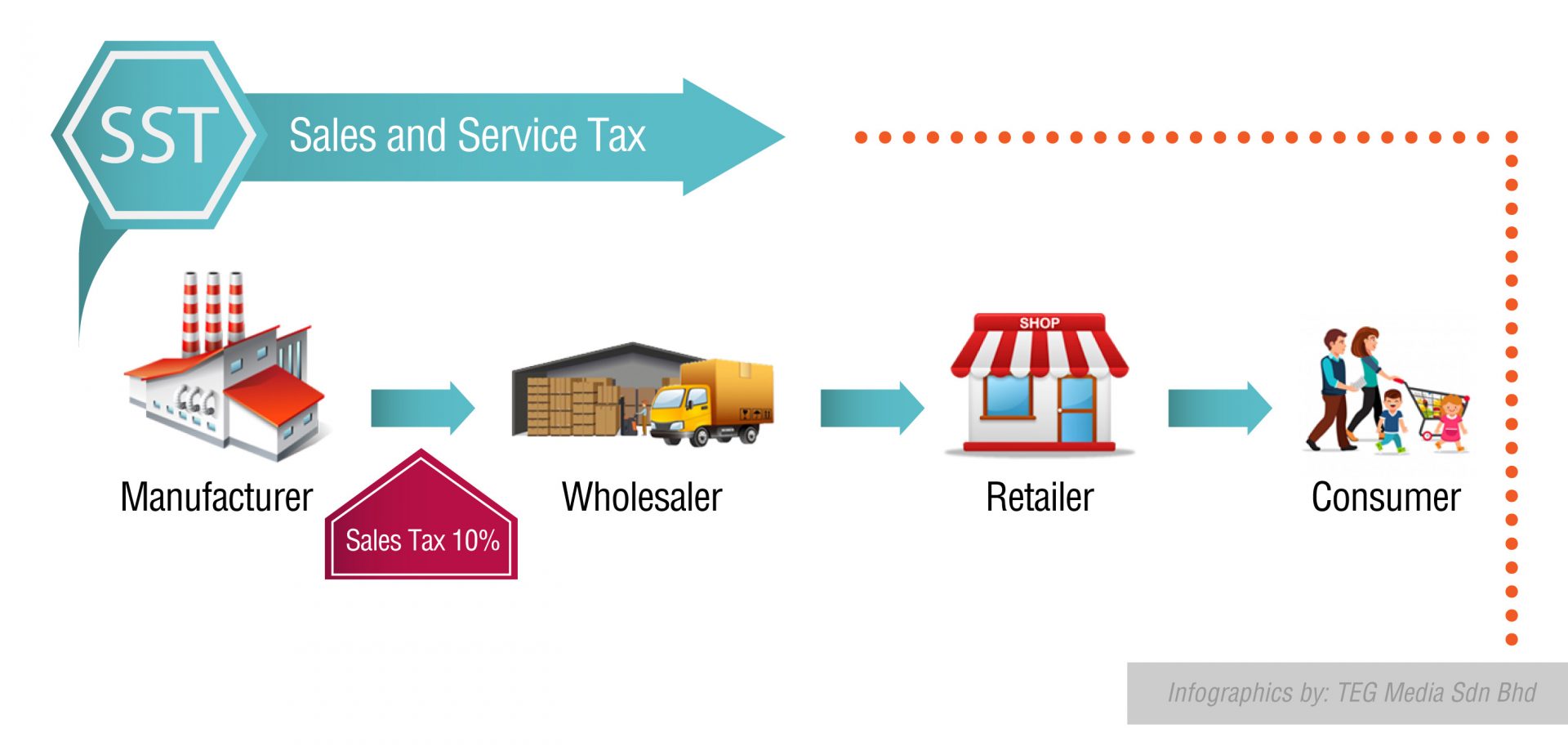

BENEFITS OF GST CONTD 3 Less. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input. Why is SST Better than GST.

If their input tax is bigger than their output tax they can recover back the. With GST businesses can benefit from recovering input tax on raw materials and incurred expenses thus reducing costs. SST has caused the productivity of sales tax to decline over the years while GST helps to increase tax productivity.

However a registered manufacturer is able to recover the GST paid on imports by crediting the amount. When the government income increases it can be used for the development and for the public. Sales tax and service tax will be abolished.

E-Poll Do you agree that Goods and Services Tax GST should be implemented in Malaysia. GST is charged on The taxable supply of goods and services Made by a taxable person In the course or furtherance of business In Malaysia GST is charged on imported goods SCOPE OF. Apart from this manufacturers and service providers are.

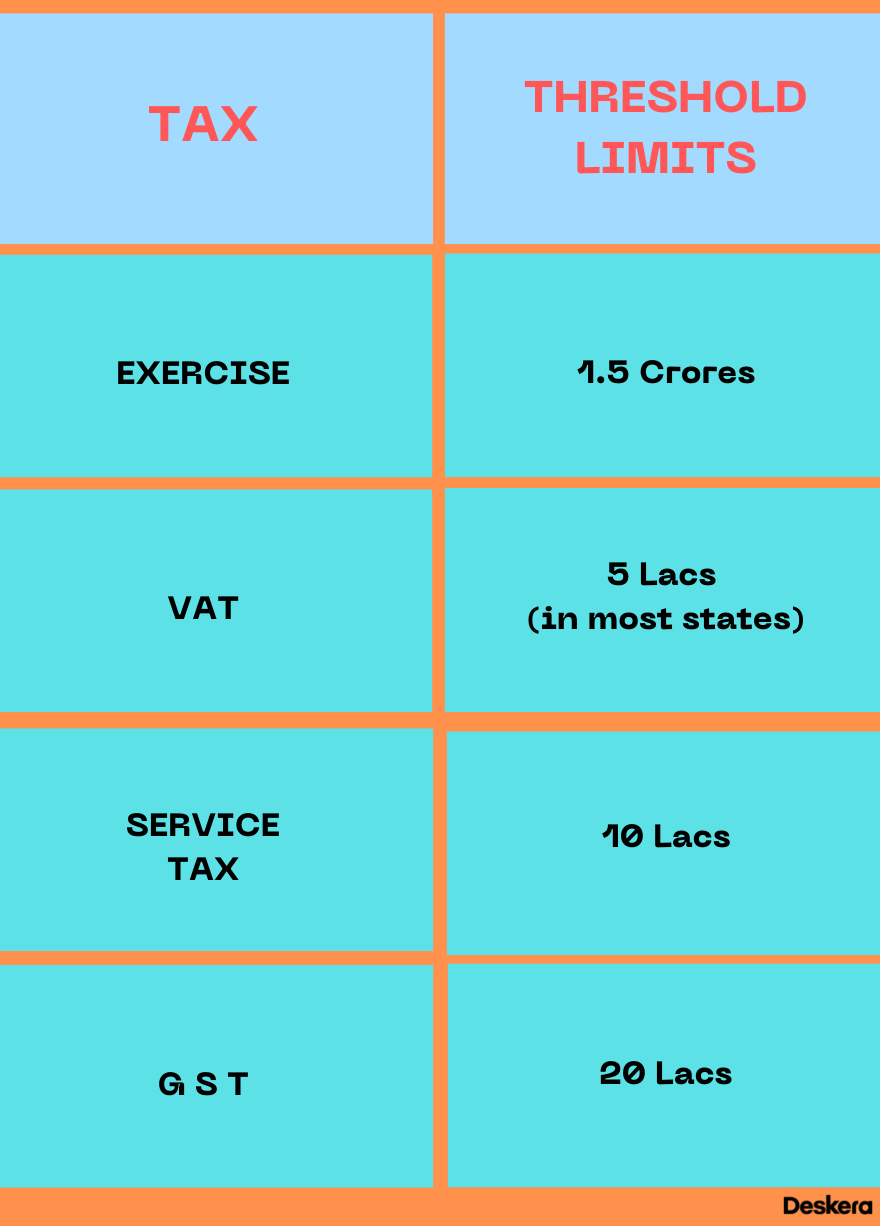

Standard-rated supplies are goods and services that are charged GST with a standard rate. First the government has always claimed that 6 of the consumption tax will replace 16 of sales and service tax. Various benefits that GST can offer to Malaysian consumers and businesses are.

They can recover credit back on their inputs. GST is collected by the businesses and paid to the government. One of its greatest benefits is the elimination of the possibility of paying double taxes because the two-pronged tax rates and policies in the SST system would have been.

Improved Standard of Living The revenue from GST could be used for development purposes for social. Three variables have mixed results which are savings investment and. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and.

The two reduced SST rates are 6 and 5. SST helps to provide. Weaknesses and to enhance effectiveness and efficiency of the existing taxation system.

Let us emphasize two points again. With GST the Government hopes to reduce the. Malaysia also has a reported critical occupations list COL highlighting job types where there is a skills shortage within the country that supports work permitsvisa applications.

GST is generally payable before the goods are released from customs control. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent. Gst is proven to be a better tax system because GSt will be administered i a fully computerised.

Sst Vs Gst How Do They Work Expatgo

Gst Vs Sst Which Is Better The Star

Advantages Of Gst 3 Advantages And Disadvantages Of Tax 3 Advantages Of Gst In Malaysia In The Studocu

Gst Benefits Advantages Disadvantage Of Gst Taxation System

Comparing Sst Vs Gst What S The Difference Comparehero

How Can Gst Accounting Software Help You Wisoft

An Introduction To Gst In Malaysia

5 Things That Will Happen In Malaysia When Gst Goes To Asklegal My

Gst Better Than Sst Say Experts

Pros Of Gst Advisory Tax And Regulatory Compliance In India Singapore And Usa

An Introduction To Gst In Malaysia

Taking Forward The Grand Gst Project Mint

Economic Times On Twitter Government May Consider Anti Profiteering Clause To Ensure Benefits Of Gst Reach Consumers Https T Co 5kz7qmb1zr Https T Co Awnxgkeyxt Twitter

Comments

Post a Comment